Methods of auditing financial statements

A financial statement audit is an independent and in-depth process to evaluate and verify the accuracy and reliability of an organization or business’s financial statements. The main objective of a financial statement audit is to ensure that the financial information published in that report fully and accurately reflects and complies with accounting principles and relevant legal regulations. So what are the methods of auditing financial statements? Please refer to the following article.

What is a financial statement audit?

A financial statement audit is a process performed by audit specialists to collect evidence and audit information to evaluate a business’s financial statements. The main task is to assess the honesty and reasonableness of financial statements compared to applicable accounting standards. A business’s financial statements provide detailed information about its financial situation, business operations, and cash flow, to assist information users in making economic decisions.

Why is it necessary to audit financial statements?

The goal of a financial statement audit is to increase users’ confidence in financial statements. This is achieved when the auditor expresses an opinion as to whether the financial statements are prepared under the principles, especially in all material respects, and determines whether they comply with the relevant standards. regarding whether to prepare and present financial statements according to applicable regulations or not.

Methods of auditing financial statements

To perform the task of verifying and expressing opinions on financial statements, financial auditors use documentary audit methods, such as balancing audits, direct reconciliations, and logical reconciliations, as well as Non-documentary audit methods, such as inventory, testing, and investigation.

Due to the fact that audit types differ in function, objects, and relationships between audit participants, the way to combine basic audit methods is also diverse. Audit methods are combined or implemented in detail depending on each specific situation. In the process of performing an audit, audit methods are often classified into two main types:

- Basic Testing: Audit procedures designed to detect fundamentally important errors in data. Substantive tests include transaction tests, account balance tests, disclosures, and basic analytical procedures.

- Control Testing: This is the process of evaluating the effectiveness of control activities in preventing, detecting, and correcting fundamentally important errors in data.

Financial statement audit procedures

Develop Audit and Risk Management Plans

Planning the audit, assessing risks, and determining risk treatments is an important part of the audit process. This requires detail and completeness in the audit plan to ensure a coherent process. During this stage, the auditor learns about the client, gathers detailed information, and evaluates the internal control system. At the same time, the audit company needs to prepare facilities and personnel to deploy the audit program.

Risks need to be carefully identified and assessed so that auditors can promptly impose risk treatment measures after assessing them.

Implement Audit Process

During the audit phase, the auditor collects evidence based on appropriate methods. This process requires proactive and proactive implementation of audit plans and programs to provide an authentic opinion on the truthfulness and reasonableness of information in financial reports.

Auditors perform detailed controls, analysis, and testing during this process. Audit procedures are determined based on the results of evaluating the client’s internal control system.

Conclusion and Audit Opinion

After the audit process, the auditor makes conclusions in the audit report or audit minutes. The auditor summarizes the results and is responsible for resolving issues that arise after the audit report has been prepared. Based on the results, the auditor can give different opinions, including unmodified opinions and unmodified opinions.

In addition, possessing international certificates such as the U.S.CMA certificate helps auditors have extensive knowledge of management accounting and auditing. This certificate is not only a testament to competence and professional knowledge but also helps auditors develop strategic thinking and give weighty opinions during the audit of financial statements.

Subjects required to have financial statements audited

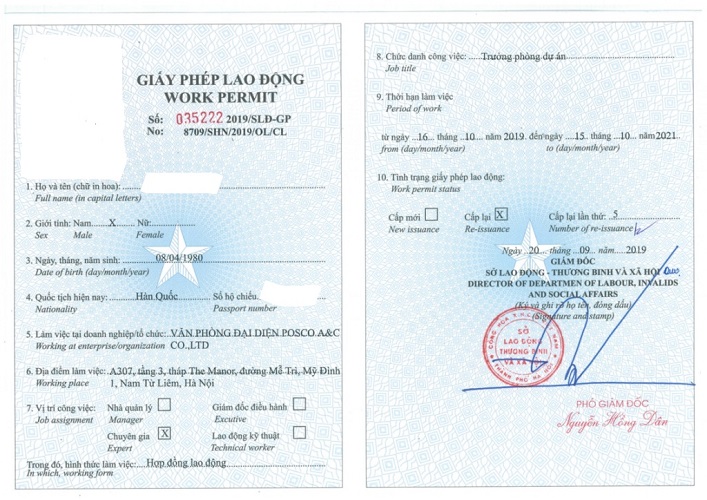

According to Article 15 of Decree 17/2012/ND-CP, subjects required to have independent audits include:

- Enterprises with foreign investment capital;

- Credit institutions operate according to the provisions of the Law on credit institutions, including foreign bank branches in Vietnam;

- Financial institutions, insurance enterprises, reinsurance enterprises, insurance brokerage enterprises, branches of foreign non-life insurance enterprises;

- Public companies, issuing organizations, and securities trading organizations.

Enterprises and other organizations must perform audits under relevant laws. The following businesses and organizations must perform audits, including:

- State-owned enterprises, except state-owned enterprises operating in the field of state secrets according to the provisions of law;

- Enterprises and organizations implementing important national projects and group A projects using state capital, except for projects in the field of state secrets;

- Enterprises and organizations in which state-owned corporations and corporations hold 20% or more of voting rights at the end of the fiscal year;

- Enterprises in which listed organizations, issuing organizations, and securities trading organizations hold 20% or more of voting rights at the end of the fiscal year;

- Enterprises performing audits, branches of foreign audit firms in Vietnam.

Enterprises and organizations subject to annual financial statement audits according to the provisions of Clauses 1 and 2 of this Article, if required by law, must prepare consolidated financial statements or general financial statements must perform an audit of the consolidated financial statements or general financial statements.

The audit of financial statements and final settlement reports of completed projects for businesses and organizations specified in Points a and b, Clause 2 of this Article does not replace the audit by the State Audit.

Businesses and other organizations conduct voluntary audits.

Phone: (+84) 961 366 238

Email:

- vphn@siglaw.com.vn

- vphcm@siglaw.com.vn

Headquarters: No.44/A32-NV13, Gleximco A, Le Trong Tan Street, Tay Mo Ward, Ha Noi.

Southern branch: No.103 – 105 Nguyen Dinh Chieu Str., Xuan Hoa Ward, Ho Chi Minh.

Central branch: 177 Trung Nu Vuong, Hai Chau District, Da Nang City

Facebook: https://www.facebook.com/hangluatSiglaw