Foreign Investors Establish Limited Liability Companies (LLCs) with two members or more

Table of contents

- Limited Liability Company with two or more members in Vietnam’s Legal Framework

- Conditions for foreign investors establishing limited liability company with two members or more

2.1. Market access conditions

2.2. Prohibited and restricted business lines regulations

- Procedures for establishing Liability Limited Company with foreign investment

3.1. Step 1: Investment registration

3.2. Step 2: Registration of a 2 or more member LLC with foreign investment

- Foreign investors receive a transfer of capital contributions in a Limited liability company with 2 members or more

With the principle of limited liability of capital contributing members, a limited liability company is an attractive business form for foreign investors when establishing enterprises in Vietnam. According to Vietnam’s legal framework, LLCs include LLCs with two members or more (multiple-member in LLCs) and single-member LLCs. Siglaw Law Firm’s article below will provide customers with information regarding establishing LLCs with two or more members by foreign investors in Vietnam.

Limited Liability Company with two members or more in Vietnam legal system

A multiple-member LLC is an enterprise with two to fifty members, both organizations and individuals. To the extent that the members contribute capital to the enterprise, they are responsible for the debts and obligations of the company.

Conditions for foreign investors establishing limited liability company with two or more members

Market access conditions

Under Article 9 of Law 61/2020/QH14 on Investment dated June 17,2000, foreign investors establishing FDI companies in Vietnam have to notice “The Negative List for Market Access”, including business lines with prohibited market access and business lines with restricted market access for foreign investors.

Prohibited and restricted business lines regulations

Regarding Law 61/2020/QH14 on Investment, prohibited business lines are regulated by Article 6. Besides, business lines that are restricted in Vietnam are also legalized in Appendix IV of the same law, therefore, investors need to research carefully to meet all the conditions before investing in Vietnam.

Procedures for establishing multi-members in LLCs with foreign investment

Establishing a new LLC company with two members or more includes two steps:

Step 1: Register investment

*With projects that do not require investment policy approval

Investors must apply for an Investment Certificate from a competent agency. An application for an investment certificate includes:

-

- – Proposal for investment project implementation when establishing foreign-invested LLCs with two or more members (form);

- – Proposal for an investment project includes the following contents: investor implementing the project, investment objectives, investment scale, investment capital and capital raising plan, location, duration, investment schedule, labor demand, proposal for investment incentives, assessment of the project’s socio-economic impact and efficiency;

- – Copy of ID card or passport for individual investor; a copy of the Certificate of Establishment or other equivalent document confirming the legal status of the institutional investor;

- – Documents explaining the financial capacity of the investors;

- – Office lease contract, Document proving the lessor’s right to lease (Land use right certificate, Construction permit, Business registration certificate with real estate business function of the lessor or equivalent documents);

- – BCC contract for an investment project in the form of a BCC contract;

- – Explanation of technology use for investment projects using technologies on the List of technologies restricted from transfer under the Law on Technology Transfer, including the following contents: name of technology, the origin of technology, technology process diagram; main specifications, usage status of main machinery, equipment and technological line;

- – Proposed land use demand; In case the project does not request the State to allocate land, lease land, or permit the change of land use purpose, submit a copy of the lease agreement or other documents certifying that the investor has the right to use the location to carry out an investment project;

- – Power of Attorney for individuals or organizations to submit documents to the Department of Planning and Investment.

- * With projects that require to apply for policy approval

- – Investors will apply for investment policy approval to different competent agencies, such as the Ministry for Planning and Investment; the Department of Planning and Investment of provinces and municipalities; Management board of industrial parks, export processing zones, high-tech zones and economic zones. Applications for investment policy approval are the same documents as investment registration.

- Depending on the size of the projects, the inverters must apply to the proper competent agencies for approval. If the enterprise is approved for the investment policy, it does not have to do the investment registration procedure.

Step 2: Registration of a 2 or more member LLC with foreign investment

Application for business registration certificate includes:

- – Application form for Enterprise Registration (form);

- – Draft charter of the business;

- – List of members

- – A valid copy of one of the authenticating documents:

- + For individuals: valid ID card or passport or citizen identification card;

- + For organizations: Enterprise registration certificate for organizations accompanied by personal identification papers of the authorized representative of the organization;

- – Investment Registration certificate

- Other documents in special cases

After preparing all documents, the investors will submit to the Business Registration Authority; or through the National Portal of Business Registration. Within 03-05 days, the Business Registration Office will issue the Business Registration Certificate if the application is valid. Then, the investors must publish information on the National Business Registration Portal. In case the competent authority refuses to grant, it must notify in writing stating the reason.

Completing the procedure after establishing

- Opening bank account: Foreign-invested companies must open a direct investment capital account for investors to transfer capital to, then transfer to a payment account to pay a cost of operating the company.

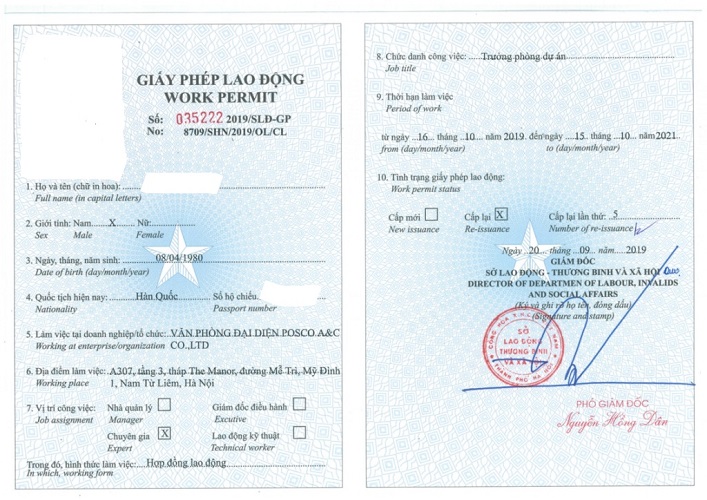

- Carrying out labor registration, reporting and applying for Work Permit for foreigners and social insurance for employees.

- Apply for licenses (if needed)

If the investors do not establish, foreign investors can receive transfer of capital contributions in limited contributions in Limited liability companies with two or more members. They do not have to implement investment registration procedures, the company only needs to register its business. This helps minimize administrative procedures later if there are changes to the business registration content.

The policy of Siglaw Law Firm guarantees the following incentives:

- Free consultation, 24/7, for all questions about capital contribution to securities trading companies in Vietnam

- Ensure to complete the work quickly, compactly, 100% on time agreed

- A team of lawyers and consultants with more than 10 years of experience in consulting and carrying out procedures for applying for capital contribution to securities trading companies

Above is the advice of Siglaw Law Firm on capital contribution to securities trading companies of foreign investors, if you have any questions, please contact us immediately via:

Phone: (+84) 961 366 238

Email:

- vphn@siglaw.com.vn

- vphcm@siglaw.com.vn

Headquarters: No.44/A32-NV13, Gleximco A, Le Trong Tan Street, Tay Mo Ward, Ha Noi.

Southern branch: No.103 – 105 Nguyen Dinh Chieu Str., Xuan Hoa Ward, Ho Chi Minh.

Central branch: 177 Trung Nu Vuong, Hai Chau District, Da Nang City

Facebook: https://www.facebook.com/hangluatSiglaw