DISTINGUISH TAXES, FEES AND CHARGES

Taxes, fees, and charges are important concepts in the field of finance and enterprises. Although each type has its concept and characteristics, many people are still confused, and can not distinguish the difference between these terms. In the following, Siglaw would like to share with readers the similarities and differences between taxes, fees and charges to help readers understand each type of revenue and determine whether you are subject to taxes, fees, or charges.

Similarities

Both taxes, fees, and charges are sources of revenue for the state budget, which is money paid by people into the state budget.

These three are all compulsory revenues that organizations and individuals must pay, except for cases of tax exemption or exemption from fees prescribed by law.

The level of payment or determination of the amount payable shall be determined by legal documents of competent state agencies.

Differences

Notion

Tax is a compulsory revenue that organizations or individuals must pay to the state when certain conditions are met. Some typical taxes such as: Value Added Tax, Personal Income Tax, Corporate Income Tax, Land Tax ,…

Fee is an amount of money that organizations and individuals must pay to basically offset costs and serve when assigned by state agencies, public non-business units and organizations assigned by competent state agencies to provide public services specified in the List of fees promulgated together with the Law on Fees and Charges 2015. Some common fees such as appraisal fee, inspection fee, assessment fee, court fee ,…

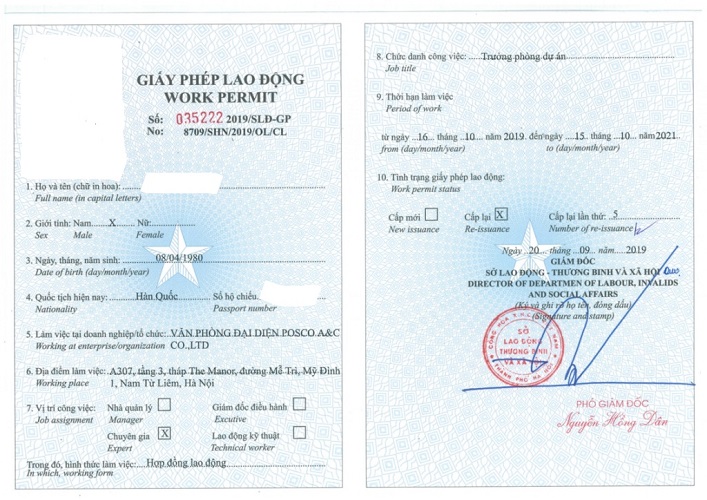

Charge is a fixed amount of money that organizations and individuals must pay when receiving public services by state agencies in service of state management specified in the List of fees promulgated together with the Law on Fees and Charges 2015. Some common fees such as: fees for issuing identity cards/citizen IDs, fees for issuing copies, registration fees,…

About the legal basis

Tax revenues are made on the basis of legal documents with high legal force such as laws and ordinances. Although there are circulars and guiding decrees, the original documents regulating taxation are laws, such as: Law on Personal Income Tax, Law on Corporate Income Tax,…

Revenues from fees and charges shall be made according to documents under the law such as resolutions, decrees, circulars, and legal documents of local authorities, such as Resolution 06/2020/NQ-HDND on the collection of fees and charges in Hanoi under the decision competence of the Hanoi People’s Council.

Role in the state budget

Taxes are the main source of revenue for the state budget, a source of financial revenue to ensure the operation of state agencies.

Fees and charges are revenues of the state budget but not primarily to offset expenses when the state, public non-business units, or other organizations provide public services or perform state administrative work.

Scope of application

The scope of application of the tax is not limited or different between localities, territories, administrative units and applies to all taxable entities.

The scope of application of fees and charges is local and local. The levy shall be decided by the People’s Council of the province/centrally-run city and only applicable within that province/centrally-run city.

Reimbursement calculation

When paying taxes, taxpayers are not entitled to direct reimbursement, but the reimbursement is reflected indirectly through the State’s activities towards society such as building infrastructure, implementing social welfare,…

Fees and charges are refundable directly to organizations and individuals through public service results.

Agency performing the collection

Taxes will be collected by tax administration agencies in accordance with the provisions of tax law

Fees and charges shall be collected by competent agencies providing public services in service of state management. Besides, there are also some types of fees and charges collected by the management tax authority.

Hopefully, our article can help readers to differentiate taxes, fees and fees. If you have any questions about legal matters, especially corporate procedures, please contact us for any questions.

For more information, please contact:

Siglaw Law Firm Limited (Siglaw Firm)

Head office in Hanoi: 12A floor, Sao Mai Building, No. 19 Le Van Luong Street, Nhan Chinh Ward, Thanh Xuan District, Hanoi City.

Hotline: 0967 818 020

Email: hanoi@siglaw.vn

Ho Chi Minh City Branch: No.103 – 105 Nguyen Dinh Chieu Str., Xuan Hoa Ward, Ho Chi Minh.