Conditions for dissolution of a foreign-owned company

Dissolution of a foreign capital company is the process of terminating and terminating the operation and existence of a foreign capital company, and at the same time terminating the legal entity status of that foreign capital company, along with related rights and obligations in the economic market. This process is strictly regulated in accordance with the provisions of the Law on Foreign Capital Companies and other relevant documents.

After the company is declared dissolved, the foreign owned company is not allowed to continue operating or carrying out any business in the name of the company. The dissolution process requires strict adherence to legal processes and procedures, including notifying regulators, settling financial obligations, and distributing foreign capital companies’ assets in accordance with regulations.

Cases of dissolution of foreign capital companies

Currently, the law stipulates cases in which foreign capital companies in general and foreign capital companies in particular are dissolved, specifically as follows:

Firstly, the foreign capital company will be dissolved when the operation is due as stipulated in the Charter and no extension decision will be made. The dissolution in this case usually involves strategic decisions based on market conditions and long-term business plans

Secondly, the decision to dissolve may come from the owner of the foreign capital company (for private foreign capital companies), the Members’ Council (for partnerships), the owner (for limited liability companies), or the General Meeting of Shareholders (for joint-stock companies). This decision usually reflects the strategic organizational and management decision of the foreign capital company.

Third, the company will have to be dissolved if it does not maintain the minimum number of members as prescribed by law for a period of 6 consecutive months without carrying out procedures for converting the type of foreign-owned company.

Fourth, dissolution due to a decision from a state agency due to the revocation of the certificate of registration of a foreign capital company. In this case, the Foreign Capital Company will lose its legal status and will not be able to continue its business activities.

1 Number of conditions for dissolution of a foreign-owned company

Conditions for dissolution of a foreign-owned company

The process of dissolving a Foreign Capital Company is a complex process and requires special attention to critical conditions. According to the law, there are specific conditions that a foreign-owned company wishing to dissolve needs to meet in order to carry out this process legally and transparently.

- First of all, the dissolution can only be carried out when the foreign capital company has guaranteed full payment of all debts and other property obligations. This helps ensure that the Foreign Equity Company does not leave any unresolved financial obligations, keeping the dissolution process transparent and accountable.

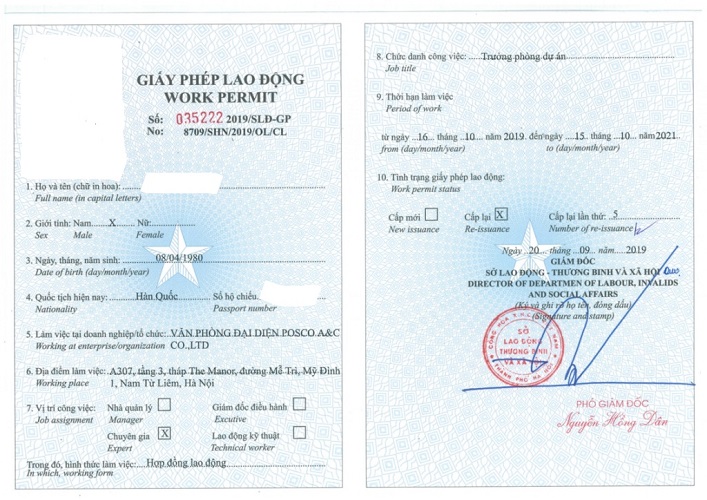

- Secondly, the dissolution process is only conducted when the foreign capital company is not in the process of resolving the dispute at the Court or Arbitration. This is to ensure that any disputes have been resolved or that there are no unfinished disputes prior to business termination.

- Another important thing is the provision of joint liability between the manager and the foreign capital company for debts. This means that both the manager and the Foreign Capital Company are jointly liable and cannot avoid liability for the debts of the Foreign Capital Company.

These conditions set important criteria and help ensure that the dissolution process takes place in a transparent, accountable, and compliant manner. This is important to protect the interests of all parties involved in the process of business termination of the Foreign Capital Company.

Process of dissolution of a foreign-invested company

The dissolution of a foreign-owned company goes through 2 steps:

Process 1: Notify the dissolution of the foreign capital company to the business registration office where the foreign capital company is headquartered

Step 1: The dossier to prepare includes:

- Notice of Dissolution of Form II-22

- Debt settlement plan (if any).

- If it is a limited liability company with two or more members, the partnership shall submit resolutions, decisions and meeting minutes of the Members’ Council. If it is a joint stock company that submits the minutes of the General Meeting of Shareholders. If it is a one-member limited liability company that submits the owner’s decision on the dissolution of the foreign capital company;

Step 2: The Business Registration Office receives the dossier, within 01 working day from the date of receipt of the notice, the Business Registration Office shall notify the status of the foreign capital company undergoing dissolution procedures on the National Portal on registration of foreign capital companies and send information about the dissolution of the foreign capital company to the Agency customs duties.

Step 3: The foreign-invested company fulfills its tax obligations with the Tax Office

Process 2: Submit the dissolution application

Step 1: The foreign-owned company shall carry out procedures for termination of operation with other dependent units at the Business Registration Office where the branch, representative office, business location is located

Step 2: The foreign capital company submits the dissolution registration dossier to the Business Registration Office where the foreign capital company is headquartered. HS includes the following documents:

- Notice of dissolution of foreign capital company form II-22 (Note: notice of dissolution in process 1 and process 2 will declare different contents)

- Report on liquidation of assets of foreign capital companies (if any)

- List of creditors and amount of paid debts (if any)

Step 3: The Business Registration Office receives the dossier and sends information about the dissolution registration of the foreign capital company to the Tax Office.

Step 4: Tax authorities send comments back to the Business Registration Office

Step 5: The Business Registration Office changes the legal status of the foreign capital company in the National Database on registration of foreign capital companies to the dissolved status if it does not receive the refusal opinion of the Tax Office, and at the same time issues a notice of the dissolution of the foreign capital company.

Step 6: After 180 days from the date on which the Business Registration Office receives the notice enclosed with the resolution or decision on dissolution of the foreign capital company, but the Business Registration Office does not receive the dissolution registration dossier of the foreign capital company and the written objection of the related party, The Business Registration Office transfers the legal status of a foreign capital company in the National Database on Registration of Foreign Capital Companies to the dissolved status, sends information about the dissolution of a foreign capital company to the Tax Office,

Step 7: Issue a notice of dissolution of a foreign capital company

Phone: (+84) 961 366 238

Email:

- vphn@siglaw.com.vn

- vphcm@siglaw.com.vn

Headquarters: No.44/A32-NV13, Gleximco A, Le Trong Tan street, An Khanh, Hoai Duc, Ha Noi, Vietnam.

Southern branch: No.103 – 105 Nguyen Dinh Chieu Str., Xuan Hoa Ward, Ho Chi Minh.

Central branch: 177 Trung Nu Vuong, Hai Chau District, Da Nang City

Facebook: https://www.facebook.com/hangluatSiglaw